An analysis of the financial inclusion in South Africa considering race, education and income

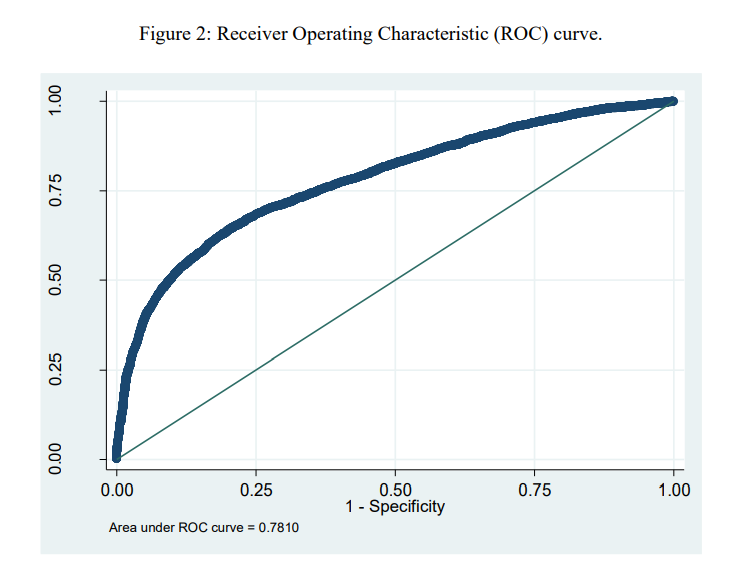

The paper examines the issue of financial inclusion in South Africa by analysing the likelihood of ownership of a bank account of an adult individual by race, education and income. Although racial segregation in South Africa was ended on May 10th, 1994, there is still considerable evidence that self-employed and entrepreneurs' successes are related to their ethnic groups. The paper examines how likely it is that higher education, after controlling for income, increase awareness of financial planning and therefore bank accounts ownership. Education is found to be a significant factor that increases the likelihood of owning a bank account. The odds of owning a bank account increases by 15% for every extra year of education, holding race and income constant. The Whites have the highest median years of education of 12 years, followed by ten years for Asians, nine years for Africans, and eight years for coloured. Copyright © 2018 Inderscience Enterprises Ltd.